Many readers asked me how I came to my company name FutureTap. So I’d like to share the history of the name FutureTap and some thoughts about naming a company in general.

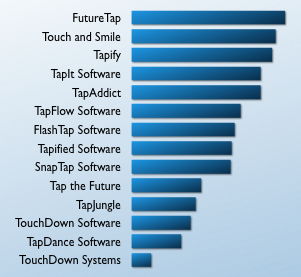

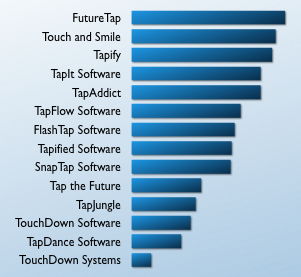

After some brainstorming in a small round of people (and some empty bottles 😉 ) I had about 8 potential names on my list. Then I asked some friends about further ideas that would fit our vision of making smart, innovative iPhone apps and extended the list to 11 candidates. I only considered names where a suitable .com domain was available.

How to choose?

It was hard to choose the best name since the „best choice“ is always very subjective and biased. Also it was important that the name would work in all major regions and languages of the world. So I decided to carry out a poll among friends using the fine (german) onlineumfragen.de service. This poll turned out as a huge success. Not only I got a better understanding of how the different names were perceived by a larger group of people. I was also presented 3 more candidates that I added to the poll.

It was hard to choose the best name since the „best choice“ is always very subjective and biased. Also it was important that the name would work in all major regions and languages of the world. So I decided to carry out a poll among friends using the fine (german) onlineumfragen.de service. This poll turned out as a huge success. Not only I got a better understanding of how the different names were perceived by a larger group of people. I was also presented 3 more candidates that I added to the poll.

How did we do?

As you can see in the results, we took the best rated name on the list which happened to be my personal favorite, too. How did we do with our selection? — Let us know in the comments.

Available disused names…

What do we do with the other 13 names? – Well, feel free to take them for your business! It just would be nice if you’d give credit somewhere on your page and let us know. (Curious to see how long it takes until the respective domains will be taken…)

When I first came across tap tap tap’s Where To sale offer, I was fascinated and scared as well. Fascinated because it would offer a jump start in the App Store; scared because of the risk involved. And puzzled about all the questions on how to do such a deal: What would be a reasonable price? Can such a transaction really work? — I’ll try to give some answers here.

When I first came across tap tap tap’s Where To sale offer, I was fascinated and scared as well. Fascinated because it would offer a jump start in the App Store; scared because of the risk involved. And puzzled about all the questions on how to do such a deal: What would be a reasonable price? Can such a transaction really work? — I’ll try to give some answers here.

Why buy an app?

Having strong developer roots, I admit that my first thought was: OK, this app really looks nice but why don’t you develop a similar one on your own? Shouldn’t be that hard. However, my experience at equinux, my former company, taught me that a) most development takes longer than anticipated and b) time-to-market is critical – especially in light of the xmas shopping season.

A second reason in this particular case: Where To is not just a bunch of Objective-C files. It’s a brand that’s well-established in the market and it comes with a really outstanding UI. So buying rather than making-yourself seemed like a good option.

How to value?

This is tough. There is not really any experience how to value an iPhone app. If you offer too much, you’ll never get your return on investment (ROI). If you offer too little, someone else gets the deal.

Sidenote

As a historical analogy we all witnessed the same inexperience of how to price an iPhone app for the consumer. What is a fair price that still allows the makers a living? Unfortunately both questions are tied together since a future change in the consumer pricing would strongly affect the app’s ROI and valuation.

Furthermore, I’m not an investment shark whose daily business is valuing products and companies. So I had to come up with my own ways of evaluating Where To’s value. One traditional model for company valuations is the discounted cash flow (DCF) method where you basically sum up future earnings indefinitely. Future earnings are discounted with an interest rate that takes into account various factors such as the risk and the cost of capital. The problem is that this method heavily relies on reliable forecasts. We didn’t have such forecasts, mainly because the whole App Store market is so fast-paced and on the other hand still in its infancy. So it’s hard to predict even roughly where the whole thing’s heading.

Furthermore, I’m not an investment shark whose daily business is valuing products and companies. So I had to come up with my own ways of evaluating Where To’s value. One traditional model for company valuations is the discounted cash flow (DCF) method where you basically sum up future earnings indefinitely. Future earnings are discounted with an interest rate that takes into account various factors such as the risk and the cost of capital. The problem is that this method heavily relies on reliable forecasts. We didn’t have such forecasts, mainly because the whole App Store market is so fast-paced and on the other hand still in its infancy. So it’s hard to predict even roughly where the whole thing’s heading.

I came up to choose the technique of using EBIT multiples. Of course, I didn’t buy a company but only a product. So I needed to calculate a virtual “product EBIT” first. Given the published numbers and estimated costs for development, marketing, support and various other operating costs, I estimated a yearly EBIT of $45,000-50,000.

My offer

We agreed on my initial offer of $70,000, where a portion of the whole transaction volume goes into services such as training and the development of new features.

This results in a multiple of 1.5 — pretty small at first sight compared to multiples of 52 for Skype and 27 for MySpace (see this summary). However, there are some important differences:

- Where To is not (yet 😉 ) as big as Skype or MySpace

- The acquisition is just about a product and no staff

- as stated before the iPhone market is still immature and future sales unreliable

- the whole thing lives off the marketing effort which is not part of the acquisition

So if everything works well, the investment will pay off in 18 months from now. To reassure the valuation, I also calculated the opportunity costs to develop a similar app by myself. The interesting thing about this calculation is that you associate the cost of time-to-market with a real number (basically, I summed the development costs and the loss of income and deducted the operational costs for support). This calculation revealed a higher value (~ $110k) than the multiple approach, so I was on the safe side.

Timing

I knew it was critical to relaunch as fast as possible to participate in the christmas shopping season. I heard rumours of anticipated 5-times higher sales volumes as usual. (I’m curious if some other devs could acknowledge this from the preliminary sales numbers – let me know in the comments.)

I knew it was critical to relaunch as fast as possible to participate in the christmas shopping season. I heard rumours of anticipated 5-times higher sales volumes as usual. (I’m curious if some other devs could acknowledge this from the preliminary sales numbers – let me know in the comments.)

Still, all the contractual work took some time (especially because our German contract needed to be translated for John). Then we relied on Apple to manage the transfer of Where To into my account. Since this is a completely manual process requiring synchronisation with people from different departments, Apple was unable to transfer the app so far. Also it is not possible to change the company name once an app is live in the App Store (which is weird since the company name can be defined on creation time for each app individually).

The solution was to relaunch Where To under the old account and wait for the transfer hopefully in January. This is the reason why Where To appears in the App Store under the company Tap Tap Tap, the seller Sophia Teutschler (the account name) and the copyright FutureTap (the only thing changeable).

Risks

The whole transaction is not without risk. Will I ever get my return on investment? How long will it take? Numerous iPhone developers complained about shortcomings of the App Store that affect sales of quality software (see for example: Trouble in the (99-cent) App Store and How to Price Your iPhone App out of Existence). Where To is no exception to this problem.

Future plans

Despite the risks I believe in a bright future for Where To. We have some exciting new features in the pipeline. Sophia thankfully commited to stay on board for some time to implement some of them. Plus we plan to extend our internationalisation efforts. German was just the beginning — we plan to add French and Italian in the first step. (Française(s) and Azzurri, contact us if you’re willing to localize Where To in your language.) So stay tuned via our news feed or follow us on Twitter… there’s some cool new stuff to come.

Despite the risks I believe in a bright future for Where To. We have some exciting new features in the pipeline. Sophia thankfully commited to stay on board for some time to implement some of them. Plus we plan to extend our internationalisation efforts. German was just the beginning — we plan to add French and Italian in the first step. (Française(s) and Azzurri, contact us if you’re willing to localize Where To in your language.) So stay tuned via our news feed or follow us on Twitter… there’s some cool new stuff to come.

Hopefully, this post was useful for some of you. If you’d like to hear more about how the whole transaction went for me, I’m willing to share some details with you. Let me know your thoughts in the comments. And if you think this was useful, please digg it to let others know about it.

It was hard to choose the best name since the „best choice“ is always very subjective and biased. Also it was important that the name would work in all major regions and languages of the world. So I decided to carry out a poll among friends using the fine (german) onlineumfragen.de service. This poll turned out as a huge success. Not only I got a better understanding of how the different names were perceived by a larger group of people. I was also presented 3 more candidates that I added to the poll.

It was hard to choose the best name since the „best choice“ is always very subjective and biased. Also it was important that the name would work in all major regions and languages of the world. So I decided to carry out a poll among friends using the fine (german) onlineumfragen.de service. This poll turned out as a huge success. Not only I got a better understanding of how the different names were perceived by a larger group of people. I was also presented 3 more candidates that I added to the poll.

Furthermore, I’m not an investment shark whose daily business is valuing products and companies. So I had to come up with my own ways of evaluating Where To’s value. One traditional model for company valuations is the

Furthermore, I’m not an investment shark whose daily business is valuing products and companies. So I had to come up with my own ways of evaluating Where To’s value. One traditional model for company valuations is the  I knew it was critical to relaunch as fast as possible to participate in the christmas shopping season. I heard rumours of anticipated 5-times higher sales volumes as usual. (I’m curious if some other devs could acknowledge this from the preliminary sales numbers – let me know in the comments.)

I knew it was critical to relaunch as fast as possible to participate in the christmas shopping season. I heard rumours of anticipated 5-times higher sales volumes as usual. (I’m curious if some other devs could acknowledge this from the preliminary sales numbers – let me know in the comments.) Despite the risks I believe in a bright future for Where To. We have some exciting new features in the pipeline.

Despite the risks I believe in a bright future for Where To. We have some exciting new features in the pipeline.